5+ Lyft Tax Calculator

Web In addition to varying immensely by city the rates you pay for each of the factors above can also vary greatly between Lyft services. Web 90 of current year taxes.

How To Write Off Car Expenses For Your Business

Web How does the IRS tax my Lyft income.

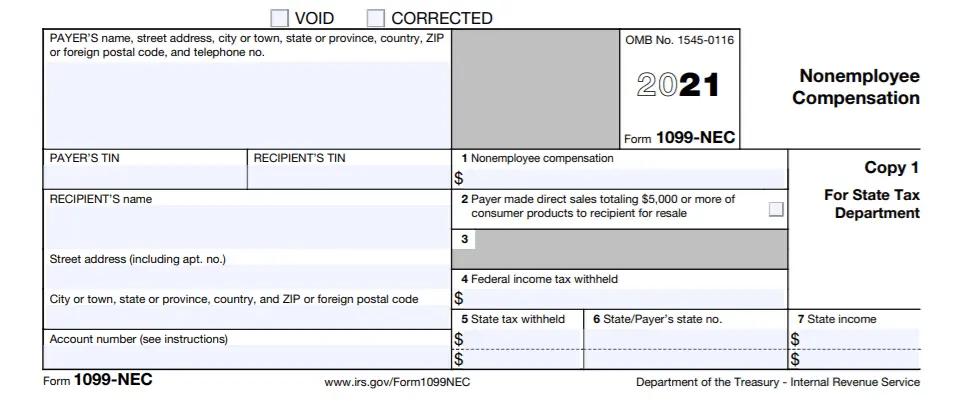

. For example the base fare in. Web Box 1 on the 1099-K shows the total amount passengers paid for the rides you gave this year. Web Surcharge on payments for services extends to tips panel says Ruling nixes 85 million award for class of passengers Fund stopped imposing fee in 2021 Jan 2.

Do I have to report my income from ridesharing. Make filing taxes easy with our step-by-step guide to the tax forms you need how to maximize your tax write-offs and more. Maximize credits and deductions on.

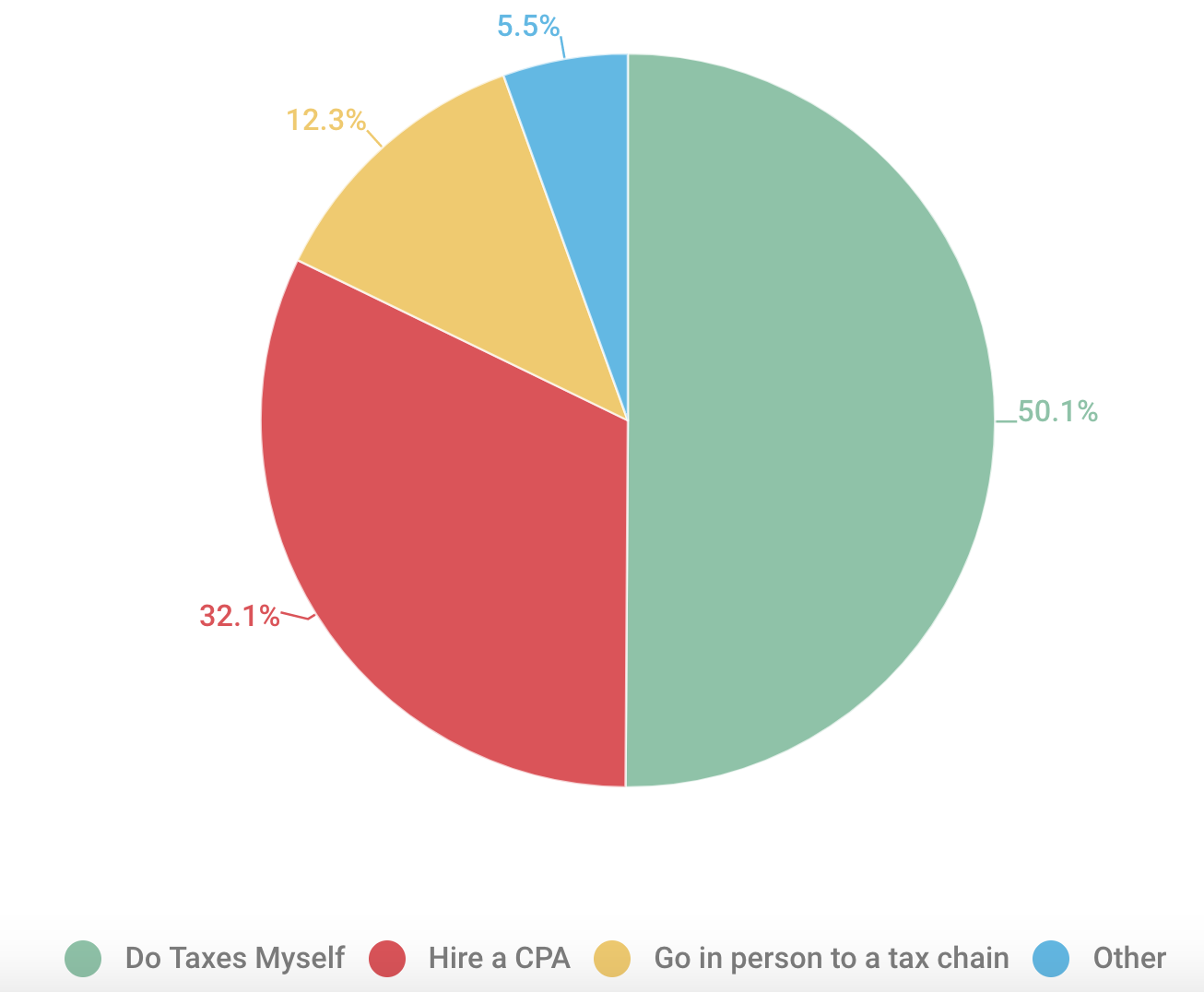

The traditional 9-to-5 job remains prevalent. Web They offer a Self Employment tax filing program as well as a wealth of information and tools like their Tax Bracket Calculator and Self Employed Expense. If you have a vehicle that qualifies for XL you.

Everything you need for easier-than-ever filing is all right here. This is just a simple calculator to see an estimate of your taxes with standard deductions. Web Lyft Fare Estimator.

Web Learn valuable tax tips for Uber and Lyft drivers including filing your tax return self-employment tax and withholding taxes. Keep more money in your pocket. Web Right from finding tax write-offs to filing your taxes in just 5 mins FlyFin is the only app you need.

Web Drive for Lyft last year. And you can mix and match. Tax Preparation Tax Planning Taxes Small Business Taxes Taxation.

AGI over 150000 75000 if married filing separate 100 of current year taxes. For the 2022 tax year the self-employment tax rate is 153 of the. Web Knowing how Lyft rides are calculated can help you better understand your ride cost.

Scans all your expenses and finds all tax deductions that apply to you. Web 3120 North Pontiac Drive Janesville Wisconsin 53545 United States to 203 West Sunny Lane Janesville Wisconsin 53546 United States. Our Lyft Estimate tool takes the guesswork out of your travel expenses.

Will I get a 1099 form. Maximize your savings with live support from TurboTax experts. These are just a few examples of common questions.

Web If you have more than 400 in income from your ridesharing work you need to pay self-employment taxes. 100 of prior year taxes. This dollar amount includes fees and taxes your passengers paid.

Planning your next Lyft ride just got easier than ever. Im not a tax expert or a professional CPA. Lyft ride pricing its made up of three parts.

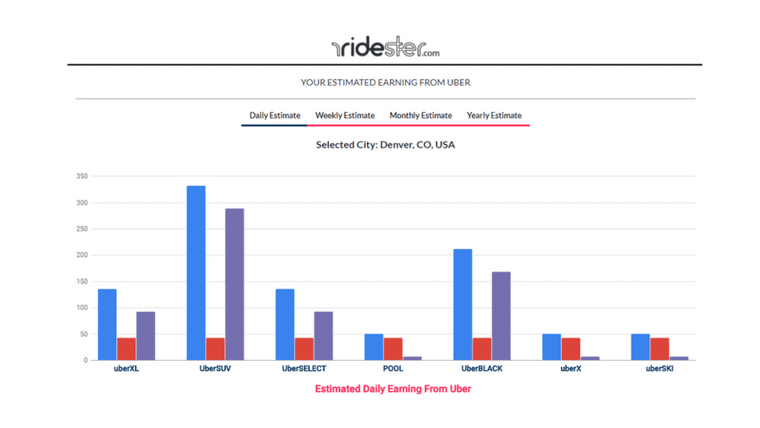

Tips to your driver. Whether for a meeting a. Web The Ridester Earnings Calculator will let you calculate earnings for all types of vehicles.

110 of prior year taxes. Local tolls or fees. Web Navigating Uber driver taxes can be a complex task for those involved in the ride-sharing services of Uber and Lyft.

Web The RideGuru price comparison tool gives accurate fare estimates and ridehailing information to help you get where you want to go whether you want to use Uber Lyft.

Honest Starting Salary Student Doctor Network

Equipment Financing And Section 179 Calculator For 2021

Revalue Chain Agence Designcontext

Uber Estimate Get A Price Estimate In Your City Uber

Tax Guide For Uber Lyft Drivers 2024 The Rideshare Guy

![]()

Lyft A Ride Whenever You Need One

How To Write Off Car Expenses For Your Business

How To Invest In Tesla Stock The Motley Fool

Tax Guide For Uber Lyft Drivers 2024 The Rideshare Guy

The Uber Lyft Driver S Guide To Taxes

Is It Worth It To Be An Uber Driver Must See Results And Earning Tips

Tax Tips For Lyft Drivers Net Pay Advance

Rideshare Driver Income Calculator How Much Will You Earn

The Uber Lyft Driver S Ultimate Guide To Taxes Ageras

Rideguru Fare Estimates Uber Lyft Taxis Limos And More

Will An Overclocked I7 3930k 4 3 4 7 Ghz Bottleneck A 3070 Ti Assuming The Ti Ever Comes Out Quora

23 Tax Write Offs For Lyft And Uber Drivers